Mzee Gerald Gikonyo Kanyuira, who says he is now aged around 101 years, is the only surviving member of the initial Rwathia Boys who walked 110km to Nairobi in 1931 in search of money.

Several decades later, they got money and a lot of it. Their children have even more.

“We started by buying the vegetables from Marikiti Market, brought in by people from Limuru, and sell them to the Asian families.

“Since there were no banks for Africans then, the young boys would send one of their friends back to the village to deliver some savings for safekeeping by the elders. When the boys in the city needed to increase their investment, they would go back to the village and get their savings.

“This cycle had a ripple effect. Seeing how their peers were able to save some money, more boys from Rwathia were encouraged to come to the city and start similar or different businesses.

“We encouraged it because we all wanted to do business together.

“After seven years of selling vegetables and doing other businesses in Nairobi, the savings groups started buying buildings from the Asians in Pumwani to set up shops and small dukas.

“A group of five to 12 people would buy one shop and jointly start a business. The Asians were selling the shops to come closer to the city centre.

“In 1951, the groups decided to start buying plots where they built houses for rental and business premises.

But this new investment was disrupted the following year when the Mau Mau issue became so hot that the Kikuyus in Nairobi had to be taken to the villages and hounded in restricted areas known as Ichagi. All they had built was razed to ashes.

“By 1957, the Mau Mau war had slowed. The colonialists started to allow some Kikuyus who had businesses back to Nairobi.

“When we returned, we decided that we would henceforth enter the city centre, where we were not allowed before.

“Our idea was to rent buildings and start businesses. But most of the buildings we wanted to rent were owned by Asians. And they were fearful of the Mau Mau war so many of them were migrating from Kenya and selling those buildings. This is how we started buying some of the buildings that we still own.

“Again, we started buying in groups as we had done in Pumwani and Majengo. As many as 30 people would buy one building.

“All the small saving groups from Rwathia worked in harmony. So, you would find one person owning shares in several groups. It was the best thing we did for ourselves.

“Today the Rwathia groups control prime properties in Nairobi especially within areas of lower Tom Mboya Street, Ronald Ngara Street, River Road among others.

“Buildings and hotels such as Magomano, Kinangop, Njoguini, Eureka and Timboroa among others are all owned by several savings groups from Rwathia.

“The big lesson that we learnt and which we would want generations to understand is that one cannot achieve much alone. It is important to cooperate, even if it is only with your wife. People should come together. This is what I tell young men from Rwathia.

“We succeeded because we had passion for our businesses. It is important for people to have passion in what they do even if they are employed. If one is not passionate, it is better to resign than spoil other people’s business. Rwathia groups thrived on trust.

“Each group would pick one of them to manage the business. Every month, members of the group come to inspect the financial books. At the end of the year, we divide the profits or re-invest.

“The seeds of capitalism sowed by the uneducated boys in the 1930s germinated and have grown into a new generation of immensely rich, influential and educated individuals in Kenya and across the world.

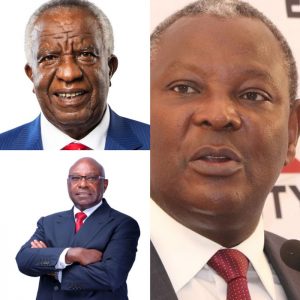

“These include people like Equity Bank Founder Peter Munga, Equity Bank CEO James Mwangi, millionaire investment banker Jimnah Mbaru among others.”